Poverty for children in the UK is growing and its time for a revolutionary shift towards Universal Basic Income (UBI).

Author: Lauren Roberts-Turner

Lauren Roberts-Turner was a young leader in Children England's ChildFair State Inquiry which brought young people together to consider the kind of welfare state that children really need. As part of the Inquiry Lauren explored the potential benefits to young people of Universal Basic Income (UBI), which she sets out in more detail here.

2017 marked the 75th anniversary of the Beveridge report which ‘became the foundation of the modern welfare state’ (Guake, 2017). In the three quarters of a century since the creation of the welfare state, Beveridge’s principle of holistic ‘Cradle to Grave’ support has been dangerously eroded, with inequality currently being at its highest since 2008.

This is unacceptable and disproportionately affects young people. The number of young people who are homeless is increasing every year with Shelter reporting the highest level of child homelessness of the decade in 2018. A recent Health Foundation report found that ‘cuts to public services [are putting] young people’s health and futures [..]at risk.’ (Bawden, 2018). This has to change.

In this article I aim to outline a possible redesign of one key aspect of the welfare state: welfare and benefits. My proposals have been informed by independent and collaborative primary research with young people and the views of experts in each field.

The quotations are verbatim quotes from the research participants. The majority of primary research used is from The ChildFair State Inquiry on which I was a young leader. This was a research project, commissioned by Children England and supported by LeadersUnlocked that aimed to “support [its participants] to research, the welfare state [that young people] want” (Darlington, 2018).

The changes I would implement aim to ensure that the welfare system young people come into contact with is truly enabling and really does support young people to have the best possible lives in our modern and ever-changing world.

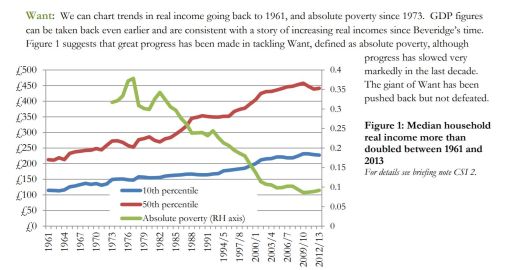

The welfare and benefits system was ‘at the heart of Beveridge’s plan to rid Britain of want’ (Richards, 2015) and yet seventy five years on, despite a marked improvement in real incomes as shown by the diagram below, 4.1 million children (more than 27%) are living in poverty in the UK, with this number set to reach 5.2 million by the end of 2021.

Figure 1. ‘What progress has been made tackling Beveridge’s five giants?’ (Richards, page 1, 2015)

This graph suggests that at least one of Beveridge’s ‘five giants’, in this case ‘want’ defined as absolute poverty, is still felt. Though largely successful at tackling absolute poverty, our current welfare and benefit system is failing to completely eradicate want and it is allowing relative poverty to increase. This can be seen by the increase in the gap between the 10th and 50th income percentile and the stagnation in the increase in the income of the lowest earners between 2009-2013.

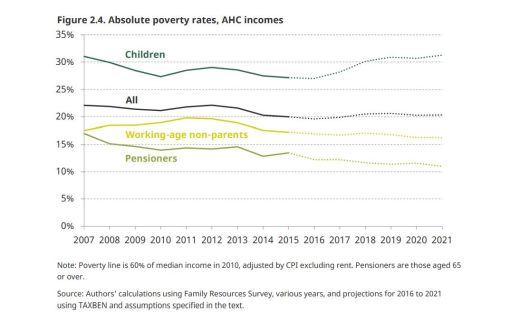

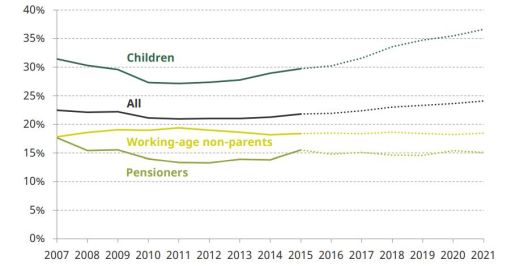

These two graphs highlight how the progress Beveridge’s system of benefits had helped achieve throughout the 1960s and into the early 2000s, is stagnating at best and in the case of children and young people, is being reversed. These terrible statistics are likely to only be made worse by the pandemic which has been reported to have pushed an additional 700,000 people into poverty so far, 120,000 of whom are children. Just as during Beveridge’s period of post-war reconstruction, radical change to the welfare and benefits system, not patching, is required post-pandemic, to ensure a bright fulfilling future is possible for all the UK’s children.

Figure 2. Absolute poverty rates 2007-2015 and predictions for 2015-2021. (Andrew Hood, 2017, p14)

This diagram shows that a greater percentage of children lived in absolute poverty in 2015, than they had in 2010, and that this is set to rise to over 30% by 2021. There is also set to be an increase in overall absolute poverty, with this graph predicting that over a 1/5 of the UK’s population will be living in absolute poverty by 2022:

Figure 3. Relative poverty rates 2007-2015 and their predictions from 2015 onwards (Andrew Hood, 2017, p15).

This shows relative poverty has increased and in set to continue doing so overall, as seen by the blue line representing ‘All’ poverty, but that this increase in poverty will disproportionately affect children. Shockingly this graph predicts that just under 2 out of 5 of children will be living in relative poverty by 2022.

The current state of the welfare and benefits system is dire. We have the "worst welfare system in western Europe" (Van Lervern, 2020), and it is in the worst ever place in its post-war history, with the pre-uplift universal credit payment only accounting for one third of the minimum wage. Young people describe it as “intimidating”, “cruel” and “leaving people starving.” They report that benefits only provide the minimum (sometimes not even that) and, many young people feel their ambitions are being curbed and report being stuck in the income poverty trap. They pointed out that “everybody will or has gone through rough times, and the welfare state should be there to help you” and suggested that if there was a more universal provision of benefits, it would ensure a level of quality for everyone and reduce the stigma that those accessing benefits face.

The view as articulated by one young person that “Universal Basic Income would be a good replacement for [the current] system” and would solve some of the problems the primary research highlighted, is one echoed by many experts in the field of welfare and benefits. Though the complex nature of the benefit system and its flaws means there are many possible redesign approaches, in this report I will focus on the one I think will have the most profound impact, the introduction of a Universal Basic Income (UBI). Simon Duffy, in his paper A Fair Income advocates a form of UBI as a way to create a “shared system for providing each other with security and support necessary for each of us to be full citizens” (Duffy, 2011). The Citizen’s Basic Income Trust (CBIT) see UBI as a way to “create a financial platform on which all would be free to build, encourage individual freedom and responsibility, help to bring about social cohesion, end perverse incentives that discourage work and savings [..and] be easy to understand.” (The Citizen's Basic Income Trust, 2017) Layla Moran (MP for the Liberal Democrats) advocates “a UBI to protect and benefit [..the] young and poor.” (Moran, 2020) And the New Economics Foundation are looking into a universal payment to those earning up to £30,000 as a replacement for our current Universal Credit system.

I therefore propose the introduction of a generous Universal Basic Income payment which provides everyone with the ability to put food on their table and the security to plan for a future which consists of more than money worries and poverty. One which offers everyone the opportunity to have their needs met and empowers young people with the capacity to dream and importantly the chance to make these dreams a reality.

The model of UBI that I think would work the best as a starting point for achieving these aims would be one similar to the radical version of UBI outlined by the CBIT in their paper Citizen’s basic income, A Brief Introduction.

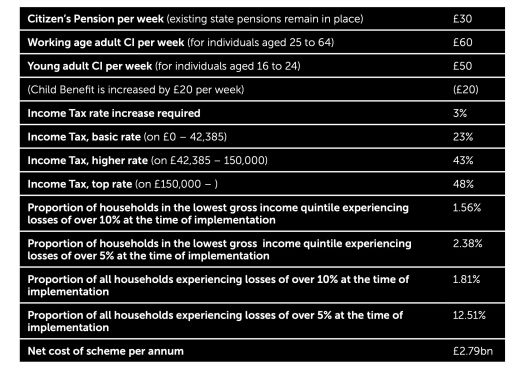

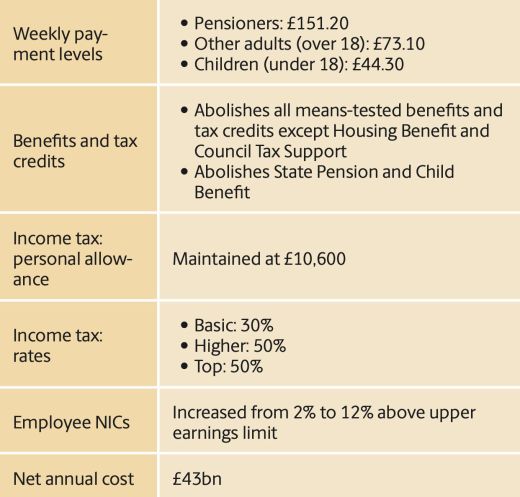

Figure 4. An Illustrative Basic Income Scheme (Citizen's Income Trust, 2017)

Figure 4 shows that the CBIT suggests the unconditional, un-means tested payment of £60 a week to adults aged 25-64, the payment of £50 to adults aged 18-24 and that child benefit should be increased by £20 a week. These payments would be administered automatically reducing the strain on, and cost to, the Department of Work and Pensions (DWP).

I agree with increasing child benefit by £20. According to current rates this would mean child benefit would increase to £41.35 for the eldest or only child and to £33.95 for all additional children. However, many 18-24 year-olds reported being frustrated at being given less money than those aged 25 and over as their living costs were largely the same and if they did get a job they would pay the same rate of tax per income bracket. One young person said “[give] 18–25-year-olds the same Universal Benefit pay as the over 25s because our housing, food and wages are exactly the same.”

I will therefore extend the payment of £60 a week to all citizens aged 18 and over. This will cause the scheme to cost more than the estimated £2.79 bn by the CBIT although, I estimate the scheme will still come in at less than £3 bn and, it will consequently require more than the 3% increase in taxation they suggest. Some argue it is acceptable to pay 18–25 year-olds lower benefits because, as 63% of those aged 18-25 were living at home in 2019, they are likely to have lower living costs. While this is true, returning to or staying in the family home is having a detrimental effect on young people and has denied them “the independence and confidence that comes with making your own home [this is] often accompanied with increased dependence on parents, leading to increased stress and mental health issues for all concerned.” (Mohdin, 2019) Paying young people lower benefits because of an assumed dependence on parents is encouraging this culture of dependence which has been described as “shattering dreams” (Mohdin, 2019) and puts vulnerable young people more at risk by making it harder for them to move out of potentially damaging family arrangements. As such it is important, that all those over the age of 18 are paid the same, if young adults are going to begin to be supported to thrive.

I would keep the payment of 16–17-year-olds at £50. This means that by their 18th birthday all British citizens will have been paid £5,200 by the government. This is a lot of money considering very few people in this age bracket have left home and therefore, they are likely to be responsible for few of their living costs. As such this money will be paid into an account in their name each month that they will be unable to access until they are 18 unless they decide to leave home earlier. This means that coming of age with (some) asset wealth will be a reality for all. This is currently not the case. “Many young adults hold little wealth” (Emmerson, 2020), 84% of young adults currently aged 19 had no financial wealth to access on turning 18, and of those whose did 50% had access to £300 or less. Therefore, even a far more modest amount than proposed in this scheme “can have a major impact on the distribution of wealth at that age” (Emmerson, 2009) This is important as the gap in wealth distribution is immense and continuing to widen. This scheme would mean for children, for whom this is their only endowment, on turning 18 they would receive more than five times what was provided by the Labour government’s Child Trust Fund scheme established in 2002.

This would allow every child to come into adulthood with some savings to fall back on which should enable them to take the risks, and do the experimentation, required to discover the career they want. For example for those who can’t access credit this money “could increase opportunities, such as to continue in education, to purchase a car, to become self-employed or to go travelling.” (Emmerson, 2009) This is likely to have an additional positive impact on young people’s life chances beyond the initial economic benefit. This is due to the asset-effect which describes the phenomenon that “holding assets can lead to a range of beneficial psychological, social and economic outcomes.” (Bynner, 2001) A recent report by the London School of Economics found “that assets have positive effects on wages, employment prospects, excellent general health and in reducing malaise.” (McKnight, 2011) As such by including 16-17 year-olds, in my suggested UBI payments we are not only valuing them as individuals and their contribution, we are helping set them up for a more equal, prosperous and healthy future, potentially reducing the cost to other public services.

One of the key aims and justification for an income tax and welfare system is to provide a more equitable distribution of income. Therefore, to finance an equal UBI payment for all adults, instead of raising all tax brackets by the same percent as the CBIT suggest, I would raise the basic tax bracket by 3% to 23% as suggested by CBIT and then raise the higher rate by 4% to 44% and the additional rate by 5% to 50%. A higher tax rate of 50% for those earning over £150,000 was introduced in 2010 and is estimated to have earned the government an additional £2.4bn that year. In the three years after it was scrapped 2013-2016 the UK Gini coefficient, the internationally recognised measurement of inequality, has increased by 1.6% from 33.2% to 34.8%. My change to the income tax system, I estimate, would both more than fund this UBI scheme and, coupled with the introduction of the scheme could help reduce the UK Gini coefficient and, lead the way to a more equal and fair society.

It may seem counterproductive to pay higher earners a Universal Basic Income in the name of equity. However, the universality of the scheme is important. It helps UBI be cost efficient as it means there would be less pressure on existing complex and confusing means-testing systems, meaning if you weren’t eligible for other means tested benefits it could mean the end of visits to “intimidating” job centres. It would also put an end to the stigma around claiming benefits and the media narrative of benefit scroungers as everyone would have first-hand experience of accessing benefits through this scheme. Finally, due to the aforementioned increased tax brackets and initial increase in earnings through the addition of UBI to citizens’ income, “the rich would pay [..] more income tax.” Their increased tax contributions would help to fund this scheme, that largely benefits the poor, and “they would be no better off than they are now.” (The Citizen's Basic Income Trust, 2017).

While it is tempting to scrap the whole DWP, which has been described as “institutionally and culturally incapable of making the reforms needed” (Pollard, 2018), the introduction of UBI does not render the DWP obsolete or unimportant. In order for Universal Basic Income to provide equity it is important we keep existing benefits, both means-tested, and non-means tested, as “a universal scheme cannot deal with variations in the cost of meeting essential needs. This is especially true of childcare, disability, and housing costs” (Lansley, 2016) . However, UBI would be taken into account when assessing the need for means-tested benefits and as such the number of eligible claimants for these is likely to reduce when UBI has been introduced.

This monthly payment of £240 for all adult citizens would alleviate the immediate hardships of poverty and provide a basic platform from which everyone has the ability to make choices about their future which aren’t limited to purely surviving. As flagged by young people “money is about survival” and can be the “reason why people stay in abusive relationships”. This has been further brought into focus during the pandemic as “women are disproportionately likely to work in the sectors that were hit the hardest by the lockdown measures,” and reports of domestic abuse have increased during the lockdown. “UBI would allow a woman being abused in a relationship [to leave] because they have that basic financial security.” (Murray, 2020). Providing everyone with enough to survive and paying each payment for those over the age of 16 into their individual bank accounts (rather than into one account for each household) would promote independence, not unintentionally disadvantage women, and help limit money as a factor of coercive control in relationships. It would also reduce the pressure on the NHS.

A study by the Joseph Rowntree Foundation found that treating health conditions linked with poverty, for example poor nutrition, exhaustion or stress, costs our health service £29 bn a year. As stated by one young person “people’s mental health relies on whether they have enough money in their lives” and the process of claiming benefits itself has been described as having “really negative effects on [..] mental health.” As such, as well as reducing the strain on physical health services, UBI may also reduce the strain on, and therefore waiting lists for, mental health services as poverty is a key risk factor in developing a mental health condition.

Figure 5. Possible UBI Scheme (Reed & Lansley, 2016)

Receiving an unconditional payment of £240 a month is a start but only provides people with just over 80% of the current rate of Job Seekers Allowance (JSA) for those over 25. This is another reason why all current unconditional and means-tested benefits would remain. If this model of UBI proved to be successful, I would then aim to increase the UBI payments to the current rate of JSA as shown in Howard Reed’s and Stewart Lansley’s model of UBI and adjust UK tax brackets accordingly.

This year the government has increased JSA for over 25s to £74.35 and in 2019 the personal allowance was increased to £12,500. I would therefore increase the ‘Other adults’ UBI payment by £1.25 accordingly and maintain the current personal allowance.

If someone receiving a current disability benefit was receiving more than the UBI payment for their age group, I would ensure that their payment was topped up to equal the same amount of money they are currently receiving. For example, the current advanced rate of the Personal Independence Payment (PIP) is £89.15 so any adult receiving this currently would have their weekly UBI payment increased by £14.80. This would ensure they weren’t disadvantaged by this scheme and that the extra cost of living with disabilities, which has been described as being “very expensive” and putting a strain on family finances, was recognised and provided for. This additional rate would be available to apply for. I would also ensure the 16–17 year-olds payment (paid into a trust fund only accessible at 18) was increased to £50, allowing everyone to experience the benefits of the asset-effect. These changes to Lansley’s and Reed’s scheme would be financed by increasing the top tax bracket from 50%, as suggested by Lansley and Reed to, 55% and implementing policies which crack down on tax evasion and avoidance to ensure the increased rate did indeed lead to increase tax revenue. In the long term the immediate increase in government spending is likely to lead to cost savings through UBI’s part in helping to reduce the strain on other parts of the welfare state such as physical and mental health services, as mentioned above.

The two aforementioned UBI schemes are introductory and aimed at establishing the concept of unconditional benefits in the national culture, rather than hugely boosting real incomes, as seen by the fact that Lansley’s and Reed’s adapted scheme only provides the meagre JSA amount. Over time I would aim to incrementally increase UBI until it pays £1500 a month to every adult aged 18 and over, which would bring everyone just above the UK poverty line. This is a similar amount to what is currently being trialled in Germany.

Though this does have the potential to reduce incentives to work as a result of the generous nature of the amount paid, “compared to a means-tested cash transfer, the universal nature of UBI could weaken the work disincentive generated by a means test” (Gentilini, et al., 2019). It could also encourage people to save and take time out to study and then be able to access more fulfilling and skilled work. Any reduced participation in the labour force that does occur as a result of the introduction of UBI could in fact be linked to increased individual and societal welfare. Reducing the need for people to participate in paid work may lead to increased value being placed on hugely beneficial voluntary work such as unpaid care work. This could have wider benefits for society as well as enabling more people to take on unpaid care work and potentially strengthen their relationships with, and reduce the stress of caring for, their disabled family member. Also, for those currently taking part in unpaid care work a Basic Income could be used to cover care costs allowing carers to take on paid work. ‘As women are commonly the primary unpaid domestic and care work providers, this could have [positive] implications for women’s participation in paid work.’ (Gentilini, et al., 2019)

A recent BBC report suggests “47% of [US employees] are at risk of being replaced by machines and 35% of jobs in the UK may similarly be threatened” (Gray, 2017). This suggests that full employment for all is unlikely to be a realistic aim in the same way full employment was for Beveridge’s Britain. In the period of rebuilding Britain after the Second World War full employment, which Beveridge defined as when “there are more vacancies for workers than there are workers seeking vacancies [with about] 3% being [temporarily] idle at any time” (Beveridge, 1944), was a real possibility. The rise of automation and the 4th industrial revolution means this is clearly no longer the case. Just as the state “ensured enough outlay [for Britain to] attain full employment” (Beveridge, 1944), as part of its new commitment to an employment focused welfare state and “the happiness of the common man” (Beveridge, 1942), our modern welfare state must adapt to ensure the happiness of its citizens in Britain’s current and future contexts. This is likely to be one in which society is less focused on employment and more on self-actualisation through other means such as volunteering and creating meaningful connections. As such some disincentivising of work through the successful introduction of a Universal Basic Income, if it leads to increased wellbeing, as was the case in the recent Finnish UBI study, would make this redesigned version of the welfare and benefits branch of the welfare state more successful than the current benefits system in which the “introduction of Universal Credit across the UK was associated with a 6.6 percentage point increase in mental health issues among recipients.” (Butler, 2020)

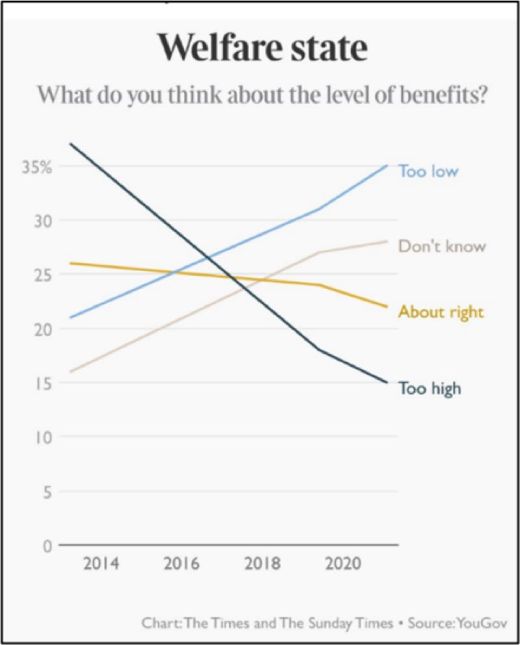

Figure 6. Public Attitudes Towards the Welfare State (The Times, 2021)

Though UBI is still seen as a novel concept by many, a recent study shows ‘around two-thirds of Europeans want governments to put in place a […] UBI’ (UBIE, 2020) and “insecurity caused by coronavirus has prompted more people to join UK groups calling for change.” (Murray, 2020) During the pandemic the number of UBI labs in the UK has risen to 41 and ahead of Rishi Sunak’s 2021 budget more than 135,000 people signed a petition, calling on him to introduce a Basic Income “to help our country recover from the social and economic shock of the COVID crisis” (Nettle, 2020). The Growing support of UBI led to co-founder of the Welsh UBI Lab, Jonathon Williams, to describe UBI as “Our Generation’s NHS.” This suggests that, though still a way from being implemented, the idea that a state sponsored UBI scheme could become a source of national pride is no longer a far-off dream or unrealistic utopian thinking. The mood for change can also be seen in the Times’ 1/03/21 Graph of the Day which shows almost 3 out of 5 people either think benefits are too low or don’t know.

To conclude, I propose the introduction of a state sponsored Universal Basic Income scheme, funded through tax revenue, as a way to reform our benefits system and improve quality of life for all British citizens. This radical and positive reform is likely to benefit children and young people the most as they are the most vulnerable in society, the most likely group to live in both relative and absolute poverty and are dependent on others for income. Beveridge described 1942, in his famous Beveridge Report, as “a time for revolutions.” Once more, the UK finds itself in a revolutionary moment this time at the hands of the Covid-19 pandemic. The revolutionary change which the introduction of such a radical universal policy would bring is definitely what is needed in this time of income and employment uncertainty. This is especially true for our benefit system as it is currently damaging the young people it is supposed to serve. The NHS is a branch of the welfare state which is universal by its very nature and as such has become a source of pride for the nation. I hope this could one day be the same for a government sponsored UBI scheme and that the United Kingdom can become a nation which takes pride in offering true ‘cradle to grave’ economic support and enabling all children and young people to thrive.

Arnold S et al (2020) Fixing the Social Safety Net. London: The New Economics Foundation.

Bawden S (2018) No jobs, no homes, no services: how inequality is crippling young people. The Guardian. [Accessed 14 November 2020].

BBC News (2010) New 50% tax rate comes into force for top earners. [Accessed 21 August 2020].

Beveridge W H (1942) Social insurance and allied services: A Report. London: HMSO.

Beveridge W H (1944) Full employment in a free society, A report. London: Allen and Unwin.

Birk R, Burnett P et al (2018) How the welfare state is failing the vulnerable. The Guardian. [Accessed 6 December 2020].

Butler P (2020) Almost 700,000 driven into poverty by Covid crisis in UK, study finds. The Guardian. [Accessed 2 March 2021].

Butler P (2020) Universal Credit Linked To Rise In Psychological Stress, Study Finds. The Guardian.[Accessed 28 December 2020].

Bynner W P J (2001) The Asset-Effect. Available at: The Asset-effect via IPPR [Accessed 25 January 2021].

Child Poverty Action Group (2002) CPAG briefing on the child trust fund. London: CPAG.

Child Poverty Action Group (2011) Measuring Poverty, measuring poverty based on income.[Accessed 8 September 2020].

Children England https://www.childrenengland.org.uk/

[Accessed 10th November 2020].

Citizen's Income Trust (2017) Citizen’s Basic Income a Brief Introduction. London: Citizen's Income Trust. Citizen's Basic Income Trust (2021) A year on: Covid's winners and losers. (Citizen's Basic Income Trust: March Update).

Henley J (2020) Finnish basic income pilot improved wellbeing, study finds. The Guardian. [Accessed 15 November 2020].

Darlington C (2018) The ChildFair State Inquiry. [Online] [Accessed 8 April 2021].

Darlington C (2020) ChildFair State Inquiry: summary of findings. [Accessed 8 April 2021].

Day C (2017) The National Archives, the Beveridge report.

[Accessed 10 November 2020].

Day C (2017) The National Archives The Beveridge Report and the foundations of the Welfare State. [Online]

[Accessed 12 October 2020].

DWP (2020) Benefit and pension rates 2020 to 2021. London: Crown copyright.

Duffy S (2011) A Fair Income, Sheffield: Centre for Welfare Reform.

Duffy S (2020) Correspondence on understanding UBI. [email].

Elliott I (2016) Poverty and Mental Health: A review to inform the Joseph Rowntree Foundation’s Anti-Poverty Strategy. London: Mental Health Foundation.

Emmerson C (2009) Should the Child Trust Fund be Abolished? [Accessed: 17 January 2021].

Emmerson C and Crawford R (2020) Coming of Age: Labour's Child Trust Funds. [Accessed: 17th January 2021].

Fenton S (2016) Poverty costs UK £78bn a year in pressure on hospitals and social services, research finds. The Independent.

Gentilini U, Grosh M et al (2020) Exploring Universal Basic Income A Guide To Navigating Concepts, Evidence, And Practices. Washington: The World Bank Group.

Gray R (2017) How automation will affect you - the experts view. BBC Future. https://www.bbc.com/future/article/20170522-how-automation-will-affect-you-the-experts-view

Guake D (2017) 75Th Anniversary of The Beveridge Report. London: Crown copyright.

Henley J (2020) Finnish Basic Income Pilot Improved Wellbeing, Study Finds.The Guardian. [Accessed 28 December 2020].

HMRC (2020) Tax credits, Child Benefit and Guardian's Allowance.

[Accessed 21st august 2020].

HMRC (updated 1 May 2020) Income Tax rates and allowances for current and past years. [Accessed 27 August 2020].

Hood A & Waters T (2017) Living standards, poverty and inequality in the UK: 2017–18 to 2021–22. London: The Institute for Fiscal Studies, pp.10-19.

Joseph Rowntree Foundation (2016) Counting the cost of UK poverty. York: Joseph Rowntree Foundation.

Lansley S & Reed H (2016) Universal Basic Income: An Idea Whose Time Has Come? London: Compass.

McFarlan L (2020) Weekly Economics Briefing 2: Fixing the Social Safety Net.

McKnight A (2011) Estimates of the Asset-Effect; The Search for a casual effects of assets on adult health and employment outcomes. London: Centre for Analysis of Social Exclusion, LSE.

Mohdin A (2019) Nearly A Million More Young Adults Now Live With Parents – Study. The Guardian. [Accessed 28 December 2020].

Moran L (2020) A Basic Income For All. On the blog: Reasons for hope: why and how we can #BuildBackBetter. [Online]

[Accessed 21 August 2020].

Murray J (2020) Our generation's NHS': support grows for universal basic income. The Guardian, [online][Accessed 2 March 2021].

Nagesh A (2019) Finland basic income trial left people “happier but jobless”. BBC News. [Accessed 23 June 2019].

National Assocation of Govenors (2010) Comprehensive School. [Online] [Accessed 10th November 2020].

Nettle D (2020) Why has the pandemic increased support for Universal Basic Income? LSE Blog Politics and Policy. [Accessed 2 March 2021].

New Economics Foundation (2020) Fixing the Social Security Net [Podcast] [Accessed 16 Apr. 2020].

Office for National Statistics (2017) Estimates of the population for the UK, England and Wales, Scotland and Northern Ireland, Mid-2016: Superseded, s.l.: Office for National Statistics.

Office for National Statistics (2019) Employee earnings in the UK: 2019. [Accessed 8 September 2020].

Office for National Statistics (2020) Average household income, UK: financial year ending 2019. [Online]

[Accessed Tuesday 8 September 2020].

Partington R (2020) UK income inequality greater than previously thought, says ONS. The Guardian.

Payne A (2020) Germany is set to trial a Universal Basic Income scheme.

[Accessed 8th September 2020].

Pollard T (2018) Pathways from Poverty: A case for institutional reform. London: Demos.

Richards., A. H. a. L.(2015) What progress has been made tackling Beveridge’s five giants?, Oxford: Centre for Social Investigation, Nuffield College.

The Department for Education (2016) Progress 8: How Progress 8 and Attainment 8 measures are calculated.

The Times (2021) Welfare state: What do you think about the level of benefits?

The World Bank Group (2016) GINI index (World Bank estimate) - United Kingdom. [Online]

[Accessed 22 August 2020].

Toynbee P (2020) Britain's 18-year-olds are being given a reminder of Labour's fight against poverty. The Guardian. [Accessed 3 September 2020].

UBIE - Unconditional Basic Income Europe (2020) Majority of Europeans Want Basic Income to Ease Covid Impacts. [Online] [Accessed 2 March 2021].

Van Lervern F (2020) Weekly Economics Briefing 5: Coronavirus And The Legacy Of Austerity.

The publisher is the Centre for Welfare Reform.

Redesigning the Benefits System with Young People in Mind © Lauren Roberts-Turner 2021.

All Rights Reserved. No part of this paper may be reproduced in any form without permission from the publisher except for the quotation of brief passages in reviews.

Basic Income, children and families, tax and benefits, England, Article