Simon Duffy looks at how the tax benefit system really works and wonders who are the real beneficiaries of this system?

Author: Simon Duffy

The tax-benefit system is unfair to people who are living in poverty. It appears to be generous, but it is not. Most people do not understand how unfair the current system really is.

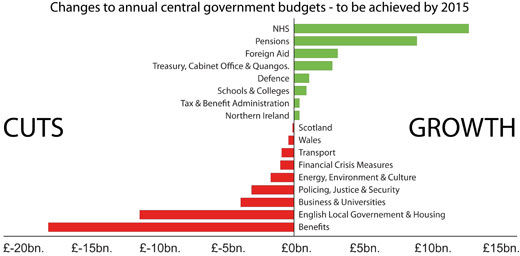

To make things worse the current UK government is targeting the benefit system for cuts (£18 billion annual cut by 2014-15) - this is shown in Figure 1. It has declared that the benefit system is in need of radical reform and it is in the final stages of passing its Welfare Reform Bill. Under the cover of something that could have been good - a redesigned tax-benefit system - we will have something that is an attack on disabled people and people in poverty.

Figure 1 Planned changes to annual UK central government expenditure by 2015

One of the things that has made this possible is the great confusion that exists in the minds of the media and, hence, the public about the way the benefit system works.

In many respects the current system works by a sleight of hand. It appears to be generous (giving about £180 billion in benefits and pensions) but actually it takes almost all of this money back through the tax system. Only a tiny amount of the benefit system provides a net benefit.

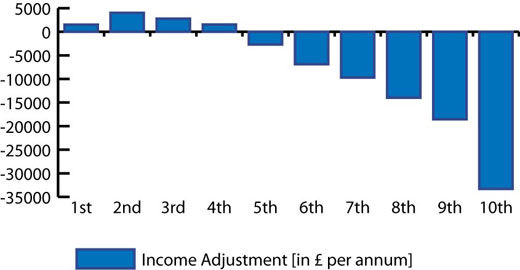

Figure 2 is based on data published by the government on the net effect of benefits and taxes for households. Households vary in size, but on average contain nearly 3 people. As the chart shows, 40% of households see their net incomes increase after benefits and taxes - but only by a very modest amount.

Figure 2 Net impact of tax-benefit system on household income (ONS data, 2009)

The overall positive adjustment for the 40% of households who do see a net improvement is only £25 billion (only 13% of all benefits paid out, about 5% of government spending and about 2.5% of GDP). The reason that this is possible is that benefit recipients are also tax payers - so much so that the benefit system hardly benefits them at all. Almost all benefits are paid back as taxes.

On average the poorest 10% of households are only £1,500 better off after paying their taxes (less than £28 per week). The idea that the benefit system is overly generous and needs to be capped is ludicrous.

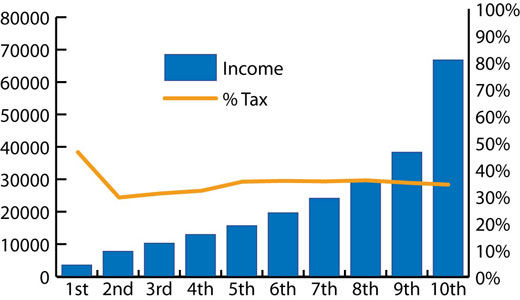

The poor not only pay taxes they also pay the highest taxes. See Figure 3 which shows the rate of tax paid by each group. For instance, the poorest 10% of households pay 47% of their income in tax. This is a higher percentage than any other group. We forget that people in poverty pay taxes because we forget how many different ways we are taxed:

Figure 3 Average income and tax paid by household for each decile (ONS data, 2009)

In addition people in poverty also pay extreme rates of what is called marginal tax - the amount paid to government for the next pound earned (although this tax is disguised as a 'benefit reduction rates' and is part of the benefit system). Often people are paying taxes at marginal rates of over 100%.

This problem, known as the ‘poverty trap’ is so great that the government has slowly begun to recognise that people often find that working can make them poorer. However the government's plans for solving this problem are problematic. Their strategy is to:

Even if we are optimistic, and hope that the economy will improve and that employment will increase, we will be left with a system that gives the poor next to nothing - while all the time pretending that it is very generous. It is worth bearing in mind that the UK is a very wealthy country - but also the third most unequal developed country. The changes planned will inevitably make us even more unequal.

If we are less optimistic then we can expect to see more people in poverty with an increase in the social problems associated with inequality (crime, mental and physical illness, reduced educational achievement).

A more positive way of resolving this problem would be to move to a system with a universal minimum income for all, and where everybody pays taxes at a fair level above the minimum income. This idea is outlined in A Fair Income.

It is natural to ask, if the welfare state doesn’t actually reduce poverty, what does it do with all that money? After all the state is currently spending over £585 billion per year. The answer is interesting. The table below sets out current government spending (from the October Spending Review 2010).

| Spend (£ billion) | Share (%) | |

| Schools and colleges | 60.6 | 10.4 |

| NHS | 101.8 | 17.4 |

| Transport | 13.1 | 2.2 |

| English local government | 38.6 | 6.6 |

| Business and universities | 20 | 3.4 |

| Police, justice & prisons | 22.4 | 3.8 |

| Defence | 35.7 | 6.1 |

| Foreign Aid | 9.6 | 1.6 |

| Energy, environ. & culture | 14.1 | 2.4 |

| Scotland | 28.2 | 4.8 |

| Wales | 14.9 | 2.5 |

| Northern Ireland | 16 | 2.7 |

| Tax Benefit Admin | 10.7 | 1.8 |

| Treasury, Cabinet, Quangos | 1.1 | 0.2 |

| Financial Crisis | 8.2 | 1.4 |

| Pensions | 71.6 | 12.2 |

| Benefits | 118.4 | 20.2 |

| TOTAL | 585 |

Most of the money goes on services, government and administration. Of course much of this is needed, and it is used by, and benefits everyone (although not equally, the poorest 10% of households actually use £1,675 less than the average household). However most of it is actually delivered through salaried posts in government and government funded agencies.

In other words less than 5% of government spending (£25 billion) is spent on directly reducing inequality and poverty, most is spent on employing people to provide services that benefit everyone (to different degrees), but which particularly benefit those who are lucky enough to be employed directly, or indirectly, by government.

There is a particular danger that those of us who work for the welfare state become rather complacent about our own role. I recently attended a seminar on welfare reform in London where an eminent speaker summarised the welfare state's function as 'being for the benefit of the poor.' Yet her audience (academics, think-tankers, civil servants) seemed, to me at least, to be the real beneficiaries of the welfare state. They were all on very high salaries, all enjoying very nice lifestyles, and all funded by the tax payer.

It is almost as if, when we work for government we don't see ourselves as beneficiaries, instead we see ourselves as doing everyone else a favour by offering them our services. We believe we are fully entitled to our own salaries, to our pensions and to our power, whereas 'the poor' should think themselves lucky to be getting our services. This is self-deception on a rather grand scale and it encourages a deeply patronising attitude to those who live in poverty.

In addition, the danger for the welfare state, is that it becomes a centralised, cumbersome and disempowering system that doesn't even tackle the most basic problem - poverty. Most of the money raised in taxes goes, not to the poorest, but to the better off - many of them functionaries of the state. It justifies its existence by the ‘good’ it appears to do - but for those with the least this claim looks very hollow indeed.

The publisher is the Centre for Welfare Reform.

Who Really Benefits from Welfare? © Simon Duffy 2012.

All Rights Reserved. No part of this paper may be reproduced in any form without permission from the publisher except for the quotation of brief passages in reviews.