The credit finance industry uses a measure of living standards that may be relevant to basic income.

Author: Stephen Poster

Two of the issues that would need to be addressed in the introduction of a Universal Basic Income (UBI) are:

Much work has been done in this area, especially in addressing the first question. One example is the Minimum Income Standard (MIS) developed by the Joseph Rowntree Foundation (JRF). The MIS is calculated by specifying baskets of goods and services required by different types of household in order to meet everyone’s needs and to ensure everyone can participate in society.

However, further evidence can be obtained by considering the approach taken by the credit finance industry and various debt advisory services. This approach is contained within the Standard Financial Statement (SFS). The SFS is a tool used where a person who is in arrears with debt summarises their income and outgoings, along with the amounts they owe. Primarily for people seeking debt advice, the SFS is mainly used by debt advice agencies and other relevant organisations. It provides a single common format for financial statements, allowing the debt advice agencies and creditors to work together to achieve outcomes for people struggling with their finances that are viable for all parties, the debtor and their creditors.

The SFS was developed and is maintained by the Money and Pension Service (MaPS) which has a statutory responsibility to improve the quality, consistency, and availability of debt advice services across the United Kingdom.

“The Money and Pensions Service (MaPS) is an arm’s-length body sponsored by the Department for Work and Pensions, established at the beginning of 2019, and also engages with HM Treasury on policy matters relating to financial capability and debt advice.” (MaPS, 2023)

Various bodies worked together in advance of the launch of the SFS to agree its principles, guidance, format and function. These included The Insolvency Service, British Banking Association, Citizens Advice and various banks and other lenders. (SFS, 2023a)

The SFS is not publicly available. Access is controlled by licensing, primarily to debt advisory agencies and those in the finance industry providing or managing personal credit. Licensing is also granted to approved researchers.

The SFS is a fully comprehensive tool that can be used to analyse a person's debts, income and outgoings. The SFS requires an individual to identify their:

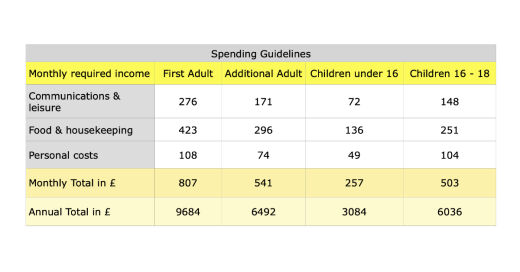

For the variable cost outgoings the SFS contains a single set of Spending Guidelines. The latest guidelines, effective from April 2023, are set out in the Table below (SFS, 2023c).

The SFS Spending Guidelines are derived using the following methodology:

It is not intended that the SFS spending guidelines form the starting point for any assessment of expenditure. However, one of the principles to which users of the SFS must adhere is:

“A commitment from creditors not to challenge statements where expenditure falls within spending guidelines” (SFS, 2023e, p3).

To that extent the credit finance industry and other creditors accept that expenditure up to the level of the guidelines is necessary to support a reasonable quality of life, even where the person is in arrears with debts. Many creditors, including major banks, have agreed to the use of the SFS. Whilst it is recognised that regulatory requirements, such as insolvency law, must always take precedence (SFS, 2023a) the courts will also accept the SFS.

The two principle limitations of the SFS spending guidelines in application to UBI are:

However, they may provide a useful indicator as to how commercial organisations like banks and other creditors view the level of expenditure necessary.

MaPS (2023) Money and Pensions Service [Online] available at https://www.maps.org.uk/ [Accessed on 25/01/2023]

SFS (2023a) Who created the SFS? [Online] available at

https://sfs.moneyadviceservice.org.uk/en/what-is-the-standard-financial-statement/who-created-the-sfs [Accessed on 25/01/2023]

SFS (2023b) SFS data entry [Online] available at

https://sfs.moneyadviceservice.org.uk/en/use-the-sfs/download-the-sfs-format-2018 [Accessed on 25/01/2023]

SFS (2023c) Spending Guidelines [Online] available at https://sfs.moneyadviceservice.org.uk/en/use-the-sfs/spending-guidelines [Accessed on 28/03/2023]

SFS (2023d) Spending Guidelines methodology [Online] available at

https://sfs.moneyadviceservice.org.uk/en/use-the-sfs/spending-guidelines/spending-guidelines-methodology [Accessed on 25/01/2023]

SFS (2023e) Standard Financial Statement User Guide [Online] available at

https://sfs.moneyadviceservice.org.uk/en/use-the-sfs/guidance-for-using-the-sfs [Accessed on 25/01/2023]

Note: Access to the pages on the SFS website is not available to the general public. The author had access via a licence granted by SFS.

The publisher is Citizen Network Research. How Much Do People Need to Live On? © Stephen Poster 2023.

Basic Income, tax and benefits, England, Article